-

Best Real Estate Markets for First-Time Investors: Key Opportunities to Consider

For first-time investors looking to enter the real estate market, selecting the right location can significantly impact their success. The best real estate markets for beginners typically offer a combination of affordability, strong rental demand, and opportunities for appreciation. These factors can provide a solid foundation for building a profitable portfolio. Cities across the United States present varied opportunities, each with unique characteristics that cater to different investment strategies. It’s essential to assess local market trends, economic stability, and population growth to make informed decisions. Understanding these dynamics helps new investors find areas where their investments are likely to yield the best returns. By focusing on regions with favorable conditions,…

-

Why Honda Owners Should Never Skimp on Quality Parts

Why Honda Owners Should Never Skimp on Quality Parts Honda’s reputation is built on reliability. Around the world, millions of Honda owners expect their Civics, Accords, CR-Vs, etc., to turn on in the morning and operate without a hitch. But what many people fail to realize is that Honda’s renowned reliability isn’t a guarantee. In fact, it’s an uphill battle when that part of an engine or transmission fails, and the owner chooses inferior replacement parts. Generic parts are tempting to buy. Car repairs are expensive, and when it comes to comparing $45 parts that works for some people versus $120 parts that does the same thing, the cheaper option…

-

Budget-Friendly Home Upgrades That Add Real Value: Smart Improvements for Every Homeowner

Homeowners often seek ways to enhance their living spaces without overspending. Budget-friendly upgrades not only improve aesthetics but can significantly increase property value. Simple changes like updating fixtures or enhancing curb appeal can have a profound impact. Investing in minor renovations can yield high returns when selling a home. They can create an inviting atmosphere and appeal to potential buyers. The right improvements can make a property stand out in the competitive housing market. Understanding which upgrades provide the best value is key. Smart choices allow homeowners to maximize their investment while enjoying the benefits of a refreshed space. High-Impact Budget-Friendly Home Upgrades Making strategic upgrades can significantly enhance a…

-

Home Buying Mistakes to Avoid: Essential Tips for First-Time Buyers

Buying a home is a significant milestone, but it comes with many potential pitfalls. Avoiding common mistakes, such as skipping the home inspection or overlooking hidden costs, can save buyers from financial strain and emotional distress. Taking a thoughtful approach can make the home-buying process smoother and ultimately more rewarding. Many first-time buyers underestimate the importance of thorough research. This includes not only analyzing the housing market but also considering long-term needs and potential resale value. By keeping these factors in mind, buyers can make informed decisions that will benefit them in the long run. Additionally, working with a qualified real estate agent can be crucial. These professionals can provide…

-

How to Manage Your Money After a Financial Setback: A Practical Guide to Recovery and Stability

Experiencing a financial setback can feel overwhelming, but it does not have to define one’s financial future. Establishing a clear budget and prioritizing expenses can help rebuild financial stability after any setback. By understanding where money goes each month, individuals can make informed decisions on necessary adjustments. Creating an emergency fund is another vital step. This fund acts as a financial buffer to prevent future setbacks from causing significant distress. Even a small amount set aside each month can accumulate, providing peace of mind and security in uncertain times. Finally, seeking professional advice can offer valuable insights tailored to individual circumstances. Financial advisors can help develop a strategic plan to…

-

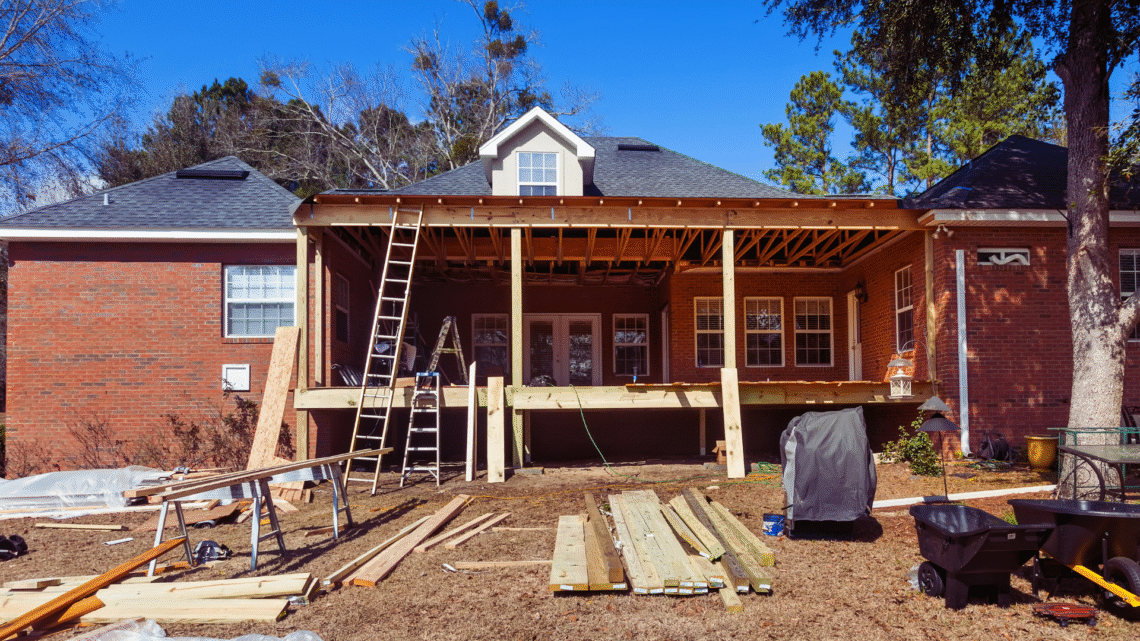

How to Plan Your Home Improvement Timeline for Successful Renovations

Planning a home improvement project can be daunting, but creating a clear timeline can make the process manageable and stress-free. A well-structured timeline helps prioritize tasks, allocate resources effectively, and set realistic expectations for completion. Understanding the phases of the project and the time needed for each can prevent delays and ensure that everything runs smoothly. Many homeowners overlook the importance of thorough planning before diving into renovations. By taking the time to map out each step, from initial research to final touches, individuals can avoid common pitfalls and stay on track. This preparation not only enhances the efficiency of the project but also maximizes satisfaction with the end results.…

-

How to Save for a Down Payment While Renting: Practical Strategies for Future Homeowners

Saving for a down payment while renting can be a challenging yet achievable goal. Many individuals aspire to homeownership, but the often high costs associated with a down payment may seem daunting. Establishing a dedicated budget and exploring creative savings strategies can significantly accelerate the process of accumulating funds for a down payment. Renters can implement practical tactics to save money, such as cutting discretionary expenses and prioritizing savings in their monthly budgets. By setting specific savings goals, individuals can stay motivated and track their progress. Utilizing high-yield savings accounts can also ensure that their money works harder for them, making each dollar saved count more towards the ultimate goal.…

-

How to Find the Best Car for Road Trip Lovers

What makes a car really road-trip ready? It’s not just about comfort, or good gas mileage, or how many cup holders it has. It’s the combination of all the right things: space, reliability, smart features, and the kind of drive that makes you want to stay behind the wheel a little longer. If you’re someone who prefers the open road to the arrival, choosing the right car isn’t just a purchase. It’s a decision that shapes your adventures. So, let’s break down what matters when you’re shopping for a car that can go the distance, and actually make it fun. Not All Cars Are Built for the Long Haul Sure,…

-

Real Estate Syndications: A Comprehensive Guide to Collaborative Property Investment

Real estate syndications have emerged as an attractive investment strategy for individuals looking to enter the property market without shouldering all the risks and responsibilities. This approach allows multiple investors to pool their resources, enabling them to access larger and potentially more lucrative real estate opportunities. By collaborating in a syndicate, investors can benefit from shared expertise and reduced financial burdens. These investment groups typically focus on multifamily properties, commercial real estate, or development projects, providing various avenues for generating passive income. Participants can enjoy the advantages of real estate ownership, such as cash flow and appreciation, while also mitigating individual exposure. The structure of syndications often involves a general…

-

Side Hustle Ideas to Boost Your Monthly Income: Practical Strategies for Financial Growth

Many individuals seek ways to increase their monthly income outside of traditional employment. There are various options available that can fit different skills, schedules, and interests. Exploring side hustle ideas can provide the financial boost needed to reach personal goals or improve overall financial stability. Freelancing, selling products online, or offering consulting services are just a few of the many opportunities that can be tailored to individual expertise and availability. For those with artistic skills, platforms like Etsy allow creators to sell their crafts directly to consumers. Meanwhile, professionals can leverage their industry knowledge by providing consulting services remotely. In a world where financial flexibility is increasingly important, side hustles…